If you're a first-time buyer considering a brand-new home in Alberta — whether it’s a quick-possession build in Edmonton or a custom home in the country — the new GST rebate introduced May 27, 2025, could save you up to $50,000 on your purchase.

We’re all about helping clients make smart financial decisions that go beyond just getting the lowest rate. This rebate is a real opportunity to reduce your mortgage amount, increase your borrowing power, and make homeownership more affordable.

What Is the First-Time Home Buyers’ GST Rebate?

The federal government is now offering a 100% GST rebate for qualified first-time home buyers who purchase or build brand-new homes in Canada. This rebate stacks with the existing GST/HST New Housing Rebate.

That means if you qualify, you could get up to $50,000 back on your purchase — a serious win for buyers trying to stretch their budget.

Who Qualifies for the Rebate in Alberta?

To qualify, you must:

Be a first-time home buyer (no home ownership in the current year or past four years)

Be 18 years or older

Be a Canadian citizen or permanent resident

Use the home as your primary residence

Be the first person to occupy the home

How Much Could You Get Back?

Home Price

Up to $1,000,000

Full rebate – up to $50,000

$1,000,001–$1,499,999

Rebate Amount

Partial rebate (phased out)

$1,500,000 or more

No rebate

What Types of Homes Qualify?

Homes purchased from a builder: Includes single-family homes, townhomes, or condos — as long as you're the first occupant.

Owner-built homes: Whether you’re building in the city or on rural land you own or lease, you’re eligible if you plan to live in the home.

Co-op housing units: Must be your primary residence and the first occupancy.

Key Deadlines to Keep in Mind

Purchase agreement or build start date must be on or after May 27, 2025

Contracts must be signed before 2031

Homes must be substantially completed before 2036

Assignments or re-signed agreements dated before May 27, 2025, don’t qualify

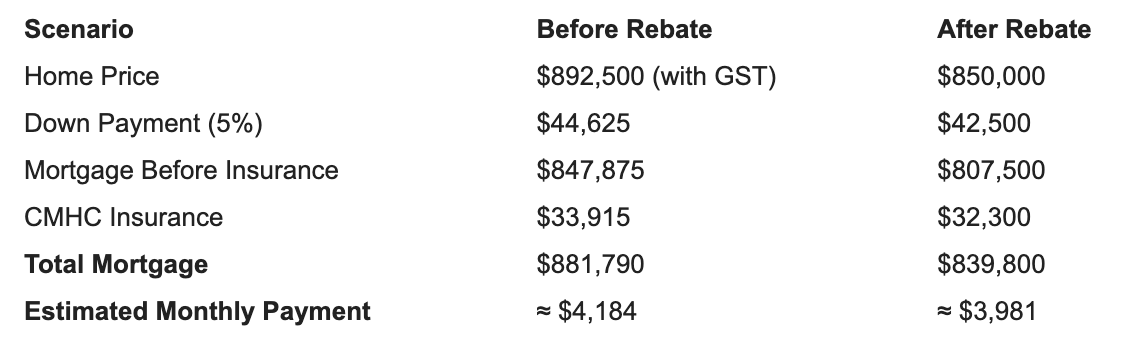

Real-Life Example: $850,000 New Build in Edmonton

Saves over $70,000 in lifetime interest

Lowers monthly payments by over $200/month

Improves mortgage qualification ratios

FAQs You Should Know

Can I stack this with other programs?

Yes! You can still use the RRSP Home Buyers’ Plan, First Home Savings Account (FHSA), and provincial programs.

Does it apply to resale homes?

No — only newly built homes and eligible co-op units.

What if only one buyer qualifies?

As long as one purchaser meets the first-time buyer criteria, you’re good.

How do I claim the rebate?

It’s typically applied at closing. I’ll guide you through the process and coordinate with your builder and lawyer to make sure it’s handled correctly.

Final Thoughts

This GST rebate is more than just a tax refund — it’s a powerful way for Alberta’s first-time buyers to lower their debt load, reduce monthly payments, and improve their chances of mortgage approval.

If you’re thinking of buying new, now’s the time to explore your options. Reach out any time — I’m here to walk you through the process and help you make the most of every opportunity.

Let’s connect: https://calendly.com/shawmortgages/discovery-call

Email: cheryl@shawmortgages.ca

Follow along for tips & updates: #shawmortgages

.jpg)