When you’re getting a mortgage, one of the biggest choices you’ll face is:

“Should I choose a fixed or variable interest rate?”

This decision is even more important during uncertain times—like a trade war or when the economy feels shaky. Let’s walk through your options so you feel confident making the right decision for your situation.

First, What’s the Difference?

Fixed Rate Mortgage

- Your interest rate stays the same for the full term (like 5 years).

- Your monthly payment never changes.

- Great if you like predictability.

Variable Rate Mortgage

- Your interest rate can change when the Bank of Canada changes its rate. They meet 8 times/year but don’t always change the rate.

- Your payment might stay the same or change, depending on the type.

Two Types of Variable Mortgages

1. Adjustable Rate Mortgage (ARM)

- Payment changes when interest rate changes.

- If rates go up, your payment goes up too.

- If rates go down, your payment goes down.

Easy to track. You always know how much is going toward principal vs interest.

2. Static Variable Payment

- Payment stays the same even if rates change.

- If rates rise, more of your payment goes to interest (and less to your principal).

- If rates drop, more goes toward principal.

If you're in a variable-rate mortgage with fixed payments, there's a risk that if interest rates rise too much, your payment might not even cover the interest anymore—this is called reaching your trigger point.

Fun Fact: Between January 2009 and February 2020 (pre-covid), the average prime lending rate was just 3.08%! That's a helpful reminder that today’s rates are still within a historically normal range, even after the recent rollercoaster ride.

For example, during COVID, we saw the prime rate drop to 2.45%, then skyrocket to 7.2%, and now it's come back down to 4.95%—all within just a few years. It's been a wild ride, but it's also a good reminder to build flexibility into your mortgage strategy.

So What Should You Choose in 2025?

Many experts believe the Bank of Canada may lower rates in the coming months because the economy is slowing down. This could make variable rates more attractive, especially a 5-year variable mortgage.

However, a fixed rate still makes sense if:

- You’re on a strict budget.

- You want full peace of mind about your payments.

- You think rates might rise.

Final Thoughts

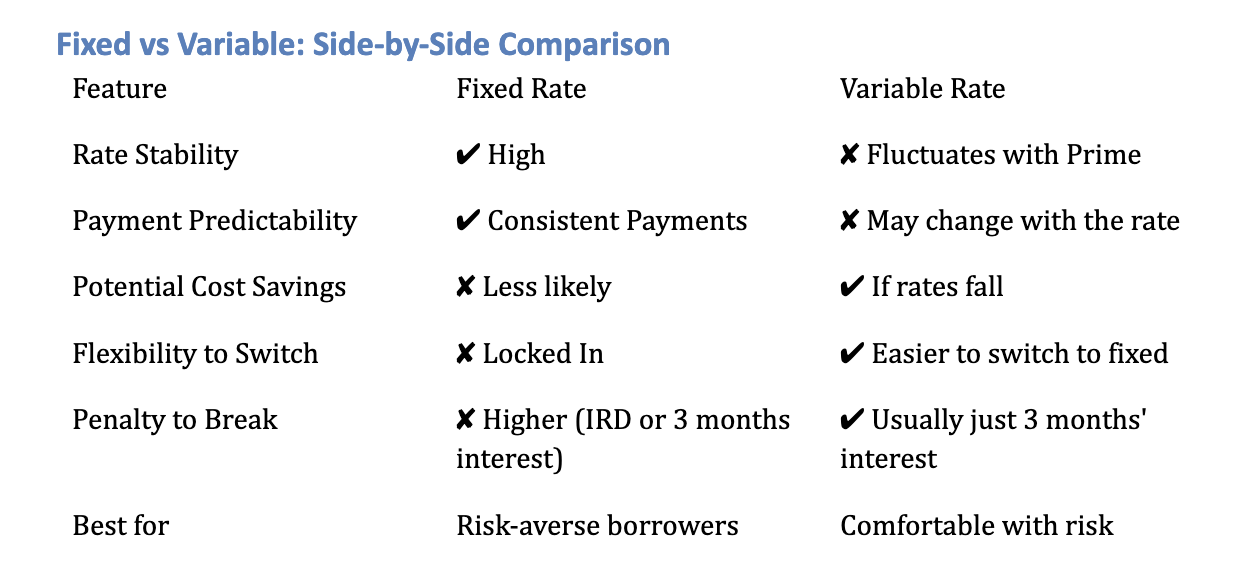

Choosing the right mortgage depends on your comfort with risk, your future plans, and where rates are heading.

- If you want predictability, go fixed.

- If you want potential savings and don’t mind some changes, variable may be the better fit.

You can also start with a variable rate and switch to fixed later—many lenders allow this without penalty.

Have questions? Let’s talk! As your mortgage advisor, I’m here to help you find the strategy that fits your life best.

Cheryl Shaw